Endowments: An Investment in the Future

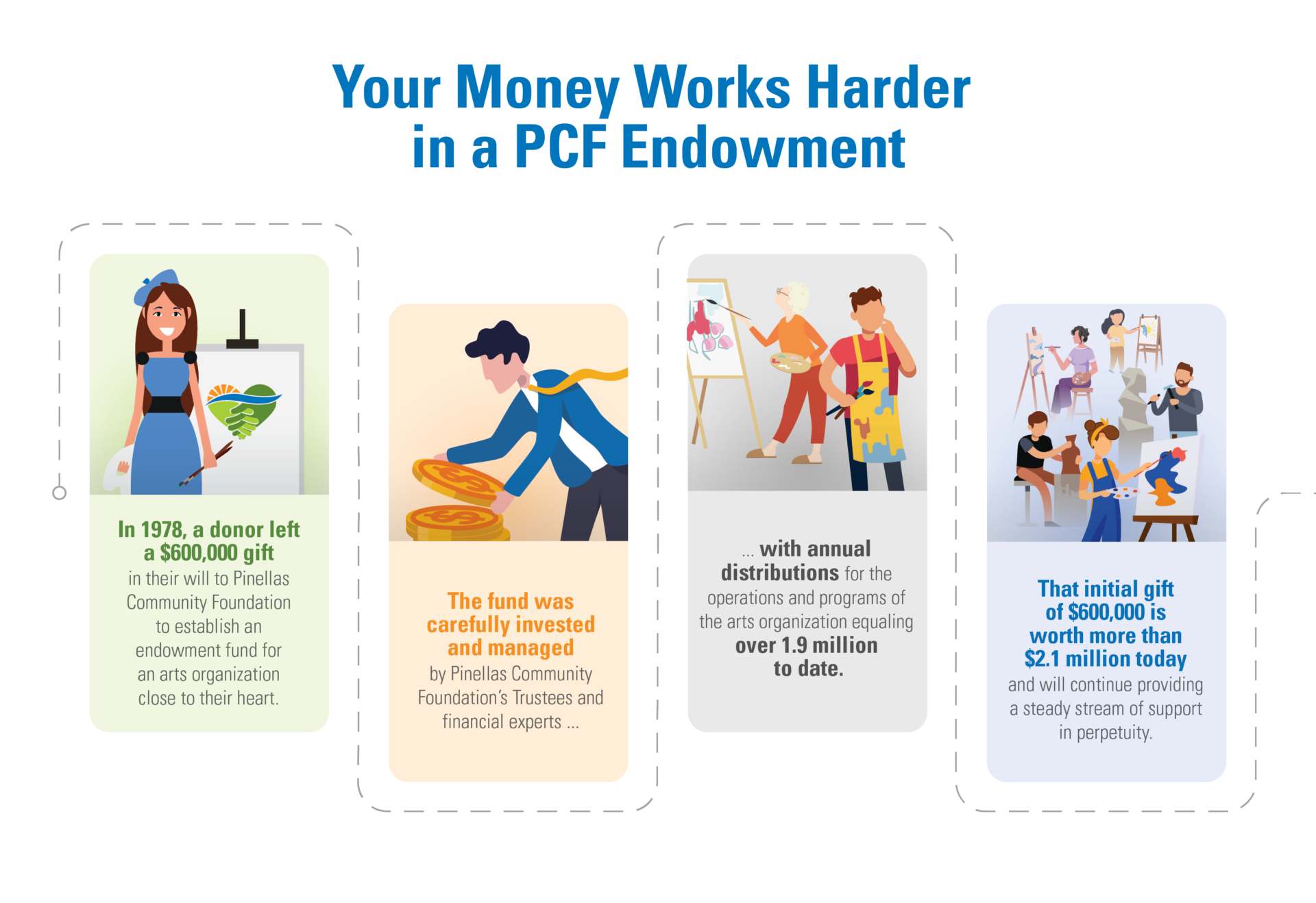

Create organizational sustainability by establishing an Endowment Fund with Pinellas Community Foundation.

Endowments are proactive, strategic plans for your organization’s long-term legacy.

An endowment fund is money that is invested to earn revenue for a nonprofit entity. Organizations and individuals can donate cash and non-cash assets, such as stock or real estate, to fund the endowment. In most cases, the fund manager holds the principle of the original investment permanently, allowing funds to grow in perpetuity. Investment earnings may be distributed to support the nonprofit’s mission, vision, and programming. This step toward financial sustainability can bring peace of mind and a sense of accomplishment.

Managing an endowment can be a big responsibility for mission-driven organizations focused on the community. Effective endowments rely on investment strategies with diverse portfolios, active management, and oversight to maximize charitable dollars. With a trusted partner’s guidance, you can easily navigate the process and increase the fund’s impact through sustainable growth. Pinellas Community Foundation wants to be your partner in designing an effective plan for your organization’s future.

Since 1969, PCF has supported the vitality of the county’s nonprofit agencies. Your success is the community’s success.

Our assets are professionally invested with active management and oversight to maximize return, support ongoing grantmaking, and create the sustainability of the Foundation.

Endowments are another opportunity for partnership. Supporting the infrastructure of PCF supports the work that we do in the community, supporting the work you do in the community.

Advantages of Agency Endowment Funds at PCF

- Resource sharing: Greater asset diversification and lower fees than smaller standalone accounts

- Attention: Access to high-quality active institutional investment management by a community partner that cares about your organization’s success

- Visibility: Increased awareness to foundation donors, community donors, professional advisors, and grantmakers

- Flexibility: Custom-designed fund agreements to best meet your organizational needs

- Advice: Optional in-depth, customized strategic services available with planned giving and fundraising experts at PCF

Simplicity for Organizations and Donors

- Quarterly reporting of fund performance

- Customizable donor receipts

- Ability to accept and process complex gifts through PCF (real estate, closely held stock, business interests, etc.)

- Donor gift receipts/tax records completed by PCF

- Assistance with determining which gifts are best for both the donor and your organization

Types of Funds

Endowment Funds

A fund permanently set aside and invested to grow over time, earning revenue through interest to fund your organization’s needs. The availability of funds for distribution and the usage of the funds are permanently restricted. ($5,000 minimum starting balance)

Quasi-endowment Funds

A more flexible fund set aside and invested to grow over time, earning revenue through interest. Typically, it’s set aside at the discretion of a nonprofit board of directors to be recalled when needed. The organization’s board determines the availability of funds for distribution and the usage of the funds. ($25,000 minimum starting balance)

FAQs

How is the annual allocation from the Endowment Fund determined?

Annually, the PCF Investment Oversight Committee recommends to the Board of Governors the amount that should be appropriated from endowment funds. The range is 3-5% of the average fund value from the prior 12 quarters. Typically, the PCF board sets the amount at 4.5%. However, you can designate a different appropriation amount in your fund agreement with PCF.

How are the funds invested?

Typically, PCF invests endowment funds in its long-term investment account. This well-diversified portfolio is designed to return spending policy plus inflation. The account includes 66% equities, 26% fixed income, 6% alternatives, and 2% cash (invested). With quasi-endowment funds, there is also an option for a shorter-term portfolio designed to provide current income while preserving principal. Typical investments are treasuries and investment-grade corporate bonds. Maturities are typically less than 10 years.

What is the average fee charged on Endowment Funds?

The average fee for funds held at PCF is between 85-87 basis points annualized. This amount includes the investment fee and the administration fees for the fund.

Pinellas Community Foundation is a 501(c)(3) nonprofit organization registered with the state of Florida. A copy of the official registration and financial information for Pinellas Community Foundation (CH3646) may be obtained from the Division of Consumer Services by calling toll-free within the state 1-800-HELP-FLA (435-7352) or visiting www.FDACS.gov. Registration does not imply endorsement, approval, or recommendation by the state. Your gift may be tax-deductible; please consult your tax professional to explore your benefits.

We Can Help

Interested in Learning More?

Set a meeting with PCF to talk directly about goals.